8000 Days: Envisioning Retirement in a New Way

Most of us have a pretty clear idea of what will occur in our lives before we retire. After we reach retirement, things begin to get a bit more out-of-focus.

Take a minute to visualize retirement. Try and picture everything you expect might occur. What exactly do you see?

Some of us might say images of packing up suitcases for yet another beach vacation. Then there are those who may envision carrying a new bag of clubs on their favorite golf courses. Others could perhaps envision holding onto their grandchildren’s hands while walking around the local zoo.

And that might be just about all a lot of us can possibly imagine.

A Life in Four Parts

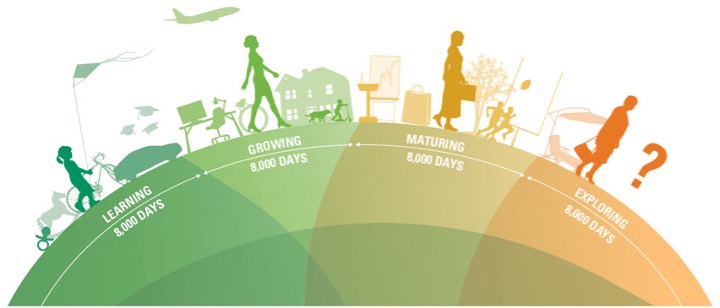

A typical American life can be easily chopped up into four separate 8,000-day segments. Each lasts about 22 years. The first three (Learning, Growing, and Maturing) have been pretty much mapped out for us by society and traditions (Figure 1). Life events familiar to all of us help frame these unique time periods from birth until when we hit retirement (Exploring). Then it starts getting a little hazy.

It doesn’t have to be that way.

Retirement is often talked about as an end. You might be focused on how to prepare for it, which is critically important. But if you’re looking at retirement as the final goal, then you might not be preparing in the best way possible.

FIGURE 1: THE FOUR LIFE STAGES

A Structure for Retirement

It’s not our fault that we have a little bit of trouble here. Although so much goes into planning for it, we simply don’t have a robust framework to create our own ideas of that time of life.

Once we begin to understand this undefined phase could potentially last 8,000 days or longer, it becomes urgent for us to strive to gain a better understanding of all it entails.

Retirement itself has many touchstones that can help us build a structure for the 8,000 days ahead. An 8,000 day retirement can be broken down into four different parts in its own right. (Figure 2)

FIGURE 2: THE FOUR RETIREMENT PHASES

- The Honeymoon Phase

The transition into retirement might be slow, rather than a clean break. First, you might cut down to working part-time or working on a consulting basis, before taking the plunge into full-scale retirement. Having someone to talk it all through with can help. - The Big Decision Phase

Once you adjust to being fully retired, you’ll start facing some big decisions. These include choosing where you will live, how you will get around, and who you will spend your time with. - The Navigating Longevity Phase

We’ll all eventually begin to experience issues with health, mobility, and cognitive abilities. Simply put, our needs will be greater, but our resources may be smaller. Surrounding yourself with trusted allies can help you make important decisions. - The Solo Journey Phase

Health or physical issues can abruptly come to the forefront at any point in retirement. But the loss of your spouse may be an even greater life event. With proper planning, you can feel optimistic about increased longevity. You can often use this period of time to reinvent yourself with renewed interest in the things you’re passionate about, too.

Understanding Retirement

As you can see, there’s a lot more to plan for than vacations, golf, and spending time with the grandkids. Your financial advisor can detail what to expect during these 8,000 days and help you co-author what this exciting and extensive next phase of your life will look like. He or she can help provide more information about an 8,000-day retirement that can help you understand and anticipate what you’ll see in the days ahead—whether that’s Day 362 or Day 3,459.