Fees

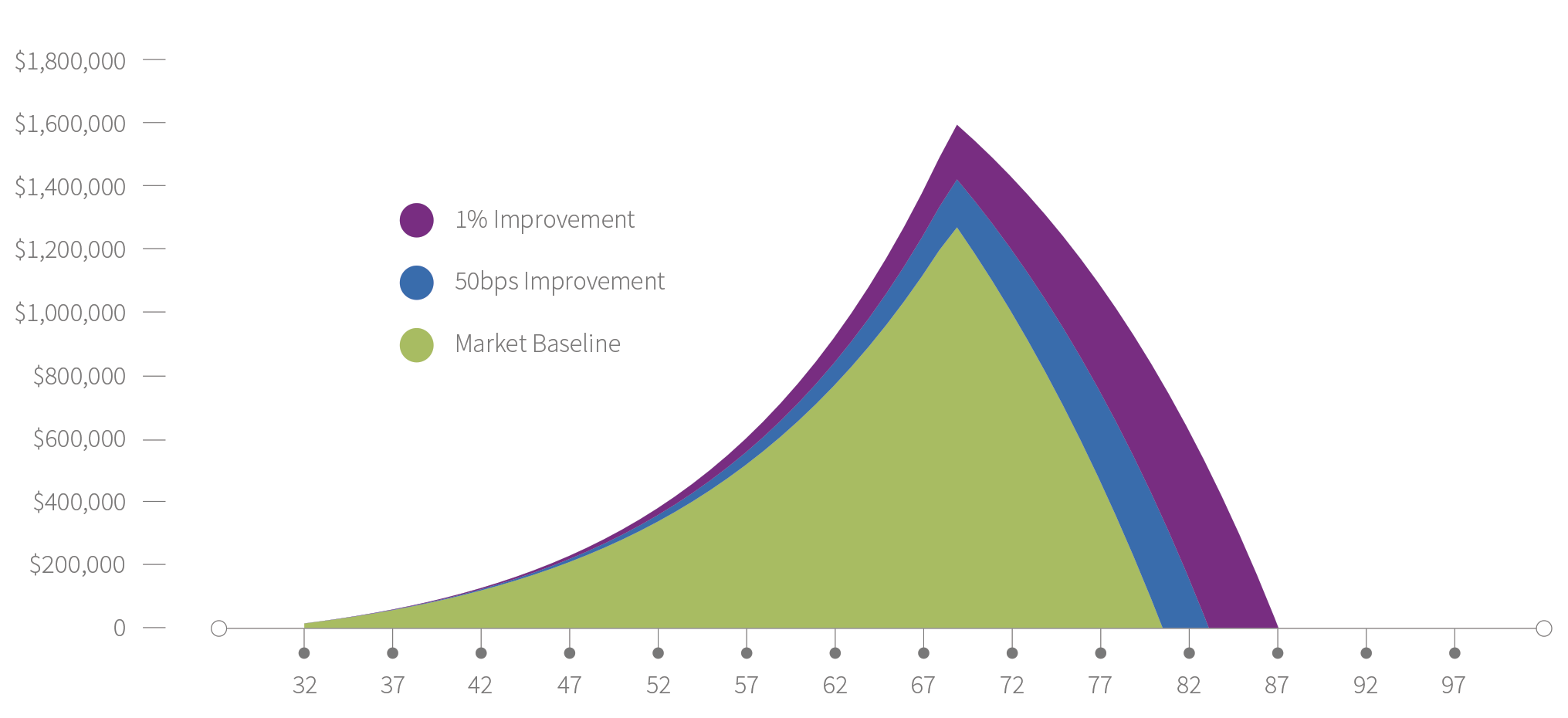

Clearly the level of fees plays a significant role in the quality of retirement outcomes.

In this example, we compare the retirement outcomes for a typical younger employee with three different levels of fees: high, moderate and low using the same market returns (7.5% pre-retirement and 6.5% post-retirement). We calculate the total assets accumulated in the retirement plan and how long those assets will last.

| Balance at Retirement | Years of Income | Age Income Stops | total Income | |

|---|---|---|---|---|

| High Fee – 1.5% | $1,285,504 | 12+ | 79 | $1,872,645 |

| Moderate Fee – 1.0% | $1,438,482 | 15+ | 82 | $2,262,099 |

| Low Fee – 0.5% | $1,612,841 | 19+ | 86 | $2,844,801 |

Typical Younger Employee

| Age | Income | Annual Increase | 401k Balance | 401k Deferral | Retirement Age | Retirement Income |

|---|---|---|---|---|---|---|

| 32 | $75,000 | 3.0% | $20,000 | 8.0% | 68 | $147,728 |