Benchmarking

Let us help you benchmark the three critical components to your retirement plan:

- Administration Fees: How do they compare to other providers in the market

- Investment Performance: How is it relative to peers, and are there better performing/lower cost alternatives

- Services: What services are being provided, and could they be improved or provided at a lower cost

We can custom build a cost-effective retirement plan that checks all your boxes, or works within your current plan to get you a better deal.

As a vendor-agnostic firm, we make sure you get the best plan for your company, regardless of the provider.

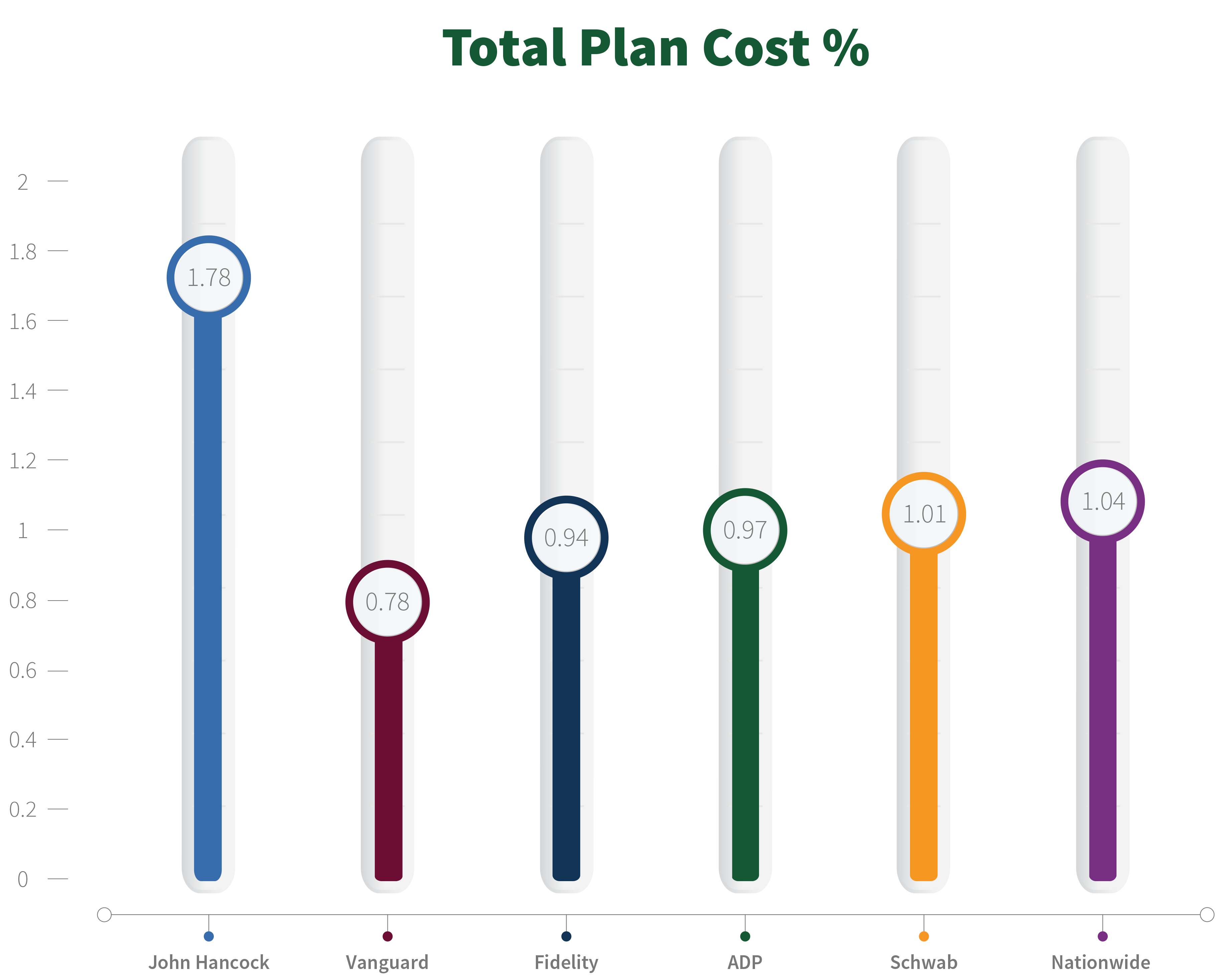

We benchmarked an incumbent retirement plan provider against nine leading providers and narrowed it down to six providers.

The Results

- Each potential provider was willing to provide the same or more services at a significantly lower cost.

- The fund lineup was improved with better performing, lower cost funds, and advisor compensation was lowered.

- The plan sponsor was successful in improving the plan, while also fulfilling their fiduciary responsibility.